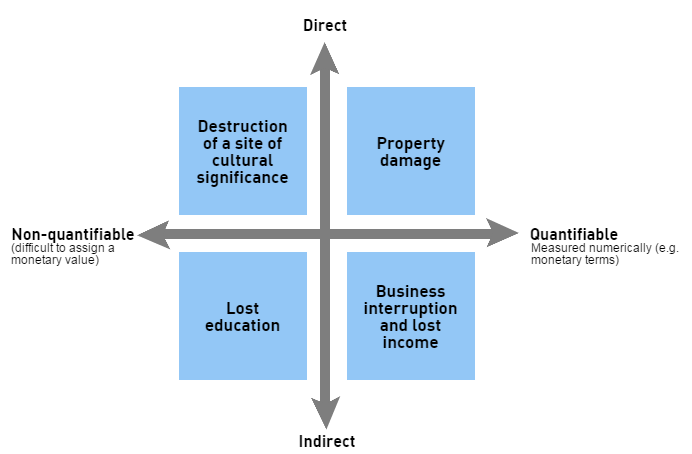

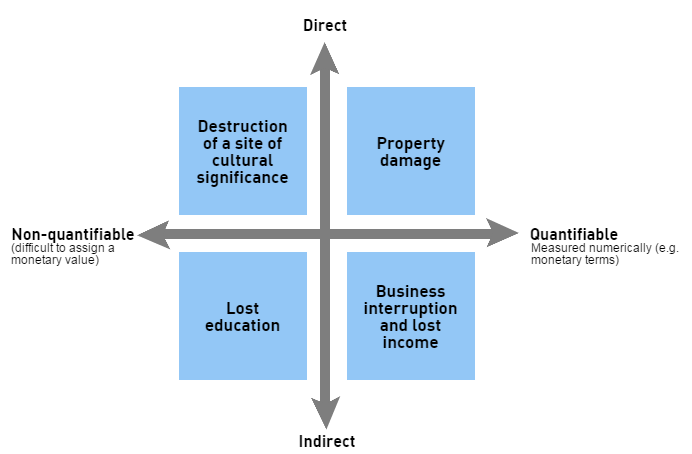

In insurance, the direct loss is the damage inflicted by a disaster, accident, or another event, referred to as “perils” in insurance language.

For eg: loss to your building or contents due to fire, smoke, shock damage from an earthquake or wind damage from a hurricane, etc. If a tornado strikes and it takes the roof off the building, a direct loss would include damage to the structure, as well as to equipment and other items inside.

Indirect losses, (“consequential losses” in business insurance policies) are not inflicted by the peril itself but describe losses suffered as a result or consequence of the direct loss. For eg- if a tornado destroys the roof of a store, the business cannot operate until the damage is fixed so the income lost during the rebuilding and, if customers stick with the alternatives they find in the meantime is an indirect loss. Or if a windstorm knocks down power lines up the street that feed your business which causes your perishable goods to spoil is an indirect loss.

So it’s critical to review your policies to see whether you have coverage for indirect losses because you can recover from direct losses but losing several months’ worth of income due to indirect losses can put you out of business.