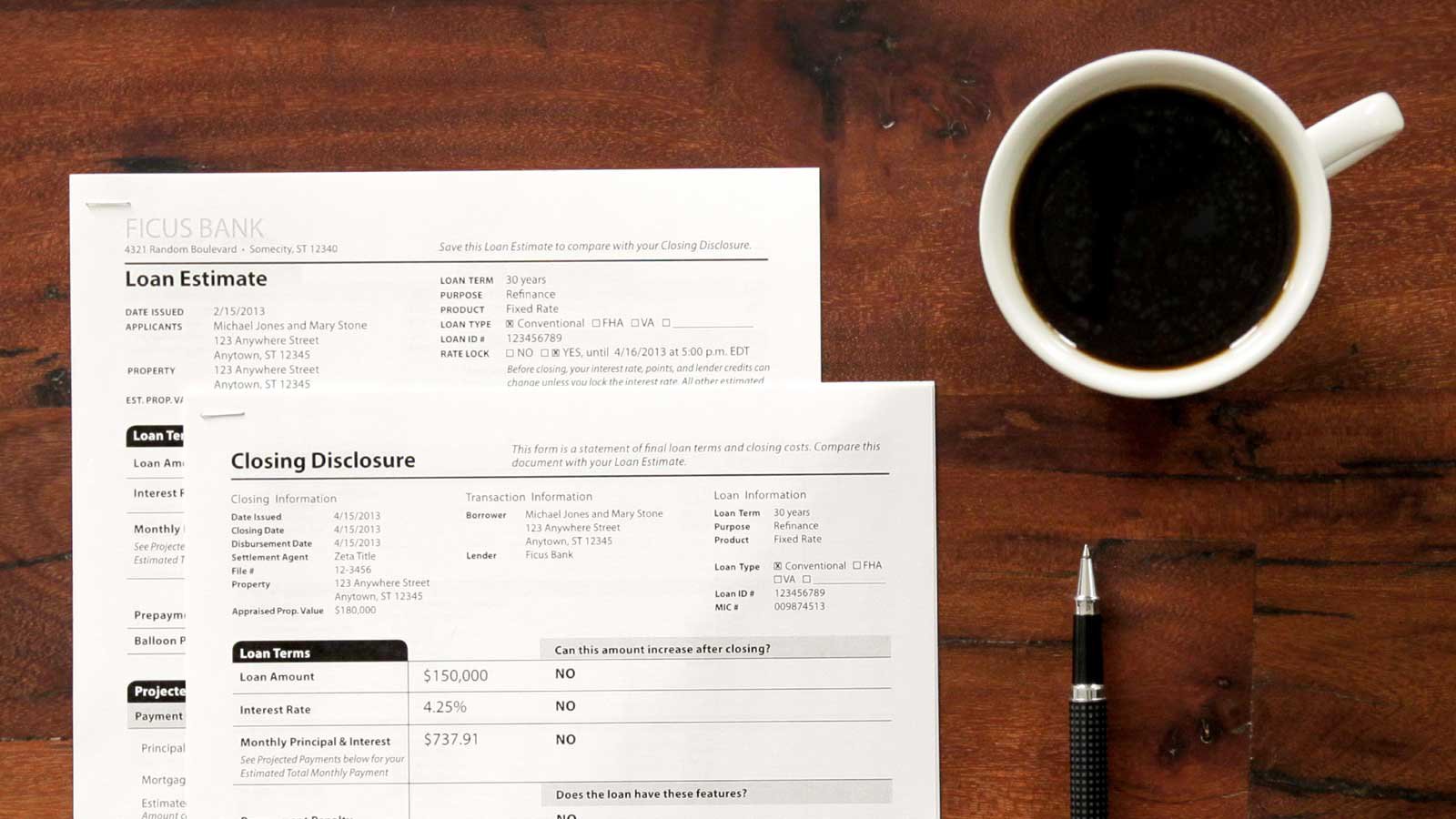

If you’re in the process of buying a home for the first time, you want to make all of the right decisions, from choosing the perfect home to finding a reliable closing agent. You’ll face a number of important decisions – and the more you know about the mortgage process, the more prepared you will be to make those decisions. When it comes to making an informed decision about the right home loan, there are two standardized documents you’ll receive in the process to help you to understand the loan that you are applying for: the Loan Estimate and the Closing Disclosure.

Navigate your way through the homebuying journey using this roadmap of key milestones and steps for success.

When shopping for a home loan, getting a Loan Estimate for each loan you apply for helps you compare the costs and terms of one loan to another. To get the best comparison, ask at least three lenders for a Loan Estimate based on the same kind of loan terms. You’ll need only six pieces of information to get started.

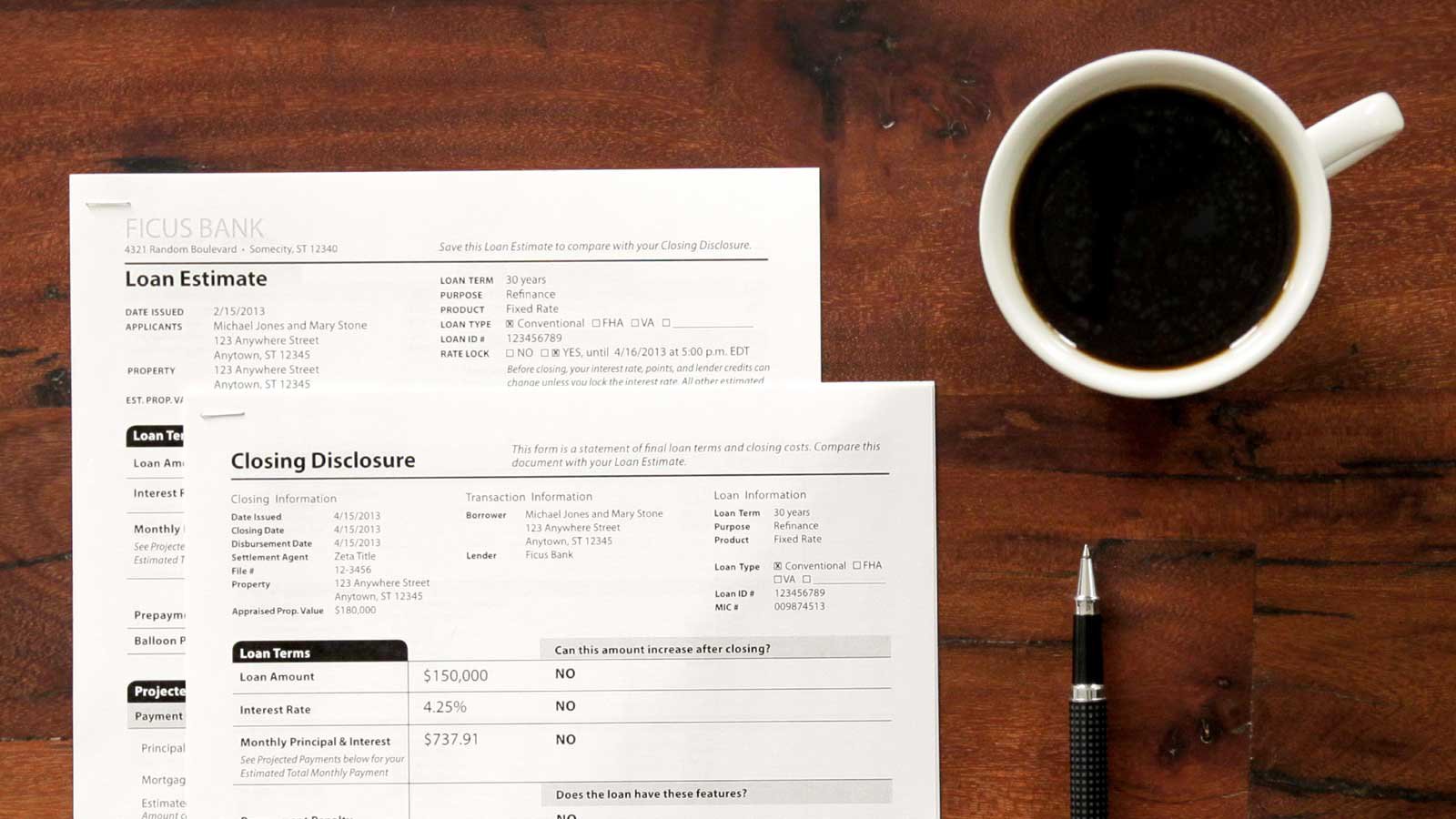

Later, after you’ve expressed your interest in moving forward with one of these loan choices (and your application has been processed and approved), you’ll also receive a Closing Disclosure, which provides the most accurate picture of the costs and terms of the home mortgage loan you’re about to commit to.

Here’s what you need to know about these two important home loan forms – and how to use them to choose the home mortgage loan that’s right for you.

A Loan Estimate is a three-page form providing important information about the mortgage loan you’re considering.

Three business days after the lender receives the following six pieces of information: your name, income, Social Security Number, the address and value of the property you’re considering, and the loan amount you’re seeking.

It provides the estimated costs associated with the loan you’ve applied for, including:

Use our Loan Estimate Explainer to understand and double check important details within your Loan Estimate.

A Closing Disclosure is a five-page form providing final details about the mortgage loan you’ve selected.

At least three business days before you’re scheduled to close on your mortgage loan.

It provides you with the actual costs of the mortgage loan you’ve selected, including:

Use our Closing Disclosure Explainer to review and understand the details within your disclosure before closing on your mortgage loan.

Some lenders may provide you with an initial loan worksheet, which can be any type of document explaining your estimated rates, terms, and payments based on initial information you’ve provided. However, unless it’s an official Loan Estimate, your actual costs and rates could be higher. Remember, if your terms, rates or any other important information changes, you may also receive a revised Loan Estimate form.

While you need to include a property address on your Loan Estimate application, you don’t need a signed contract on a home. Ideally, you’d be requesting quotes from several lenders before you enter into a contract to buy a house. This should help you to be sure that you fully understand the costs and terms and that you’re choosing the loan and lender that’s right for you.

Choosing the right mortgage loan and lender is a critical step in the homebuying process. Make sure you’re getting what you expected, and when in doubt, always ask questions until you feel comfortable with the loan you’re able to commit to.

Whether you’re thinking about buying or you’re ready to close, our Buying a House tool can help you navigate and make informed decisions at each stage of the homebuying journey.